san francisco payroll tax calculator

Important note on the salary paycheck calculator. Tax rate for nonresidents who work in San Francisco.

California Alimony Payments Taxes Quick Video

See reviews photos directions phone numbers and more for the best Tax Return Preparation in San Francisco CA.

. From imposing a single payroll tax to adding a gross receipts tax on. Depending on your type of business you may need to pay the following state payroll taxes. To get started please enter the following information about your property.

Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more. This calculator can only provide approximate estimates for 100 ownership transfers. Form 941 Employers QUARTERLY Federal Tax Return Quarterly typically due at the end of April July.

The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. Ad Process Payroll Faster Easier With ADP Payroll. Youll pay this state.

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Your household income location filing status and number of personal. Although this is sometimes conflated as a personal income tax rate the city only levies this tax. Get Started With ADP Payroll.

Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. Ad Process Payroll Faster Easier With ADP Payroll. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Give us a call. Proposition F fully repeals the Payroll Expense. Although this is sometimes conflated as a personal income tax rate the city.

San francisco payroll tax calculator. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes. Social Security has a wage base limit which for 2022 is.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Discover ADP Payroll Benefits Insurance Time Talent HR More. Intelligent user-friendly solutions to the never-ending realm of what-if scenarios.

California state payroll taxes. Our payroll tax services. San Francisco Payroll Tax Calculator.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The Payroll Division is responsible for paying employees as provided by the Citys various labor agreements and processing pay adjustments payroll deductions employee W-4 forms in. Use the Free Paycheck Calculators for any gross-to-net calculation need.

Payroll expense tax py proposition f was approved by san francisco voters on november 2 2020 and became effective january 1 2021. This 153 federal tax is made up of two parts. Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the.

Get Started With ADP Payroll. Accuchex is known for its impeccable assistance with payroll taxes which is why we are a trusted provider for payroll taxes service in San Francisco. Please refer to the table below for a list of 2021 Payroll.

California unemployment insurance tax. This and many other detailed reports are available with your secure login to Time2Pay. Payroll Expense Tax.

State Disability Tax provides temporary funding for non-work related disabilities as well as paid family leave for those caring for an ill family member or bonding with their. 124 to cover Social Security and 29 to cover Medicare. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Tax Compliance For Influencers Filing Taxes In 2022

Payroll Calculator Bc Top Sellers 53 Off Www Ingeniovirtual Com

Where To Find Free Tax Help Nbc Bay Area

Bill Com Vs Gusto For Paying Contractors

How To Calculate Property Tax And How To Estimate Property Taxes

Accounting In Sf Bay Area Taskrabbit

How To Calculate Property Tax And How To Estimate Property Taxes

How To Calculate Compensation For Remote Employees 2022 Remote

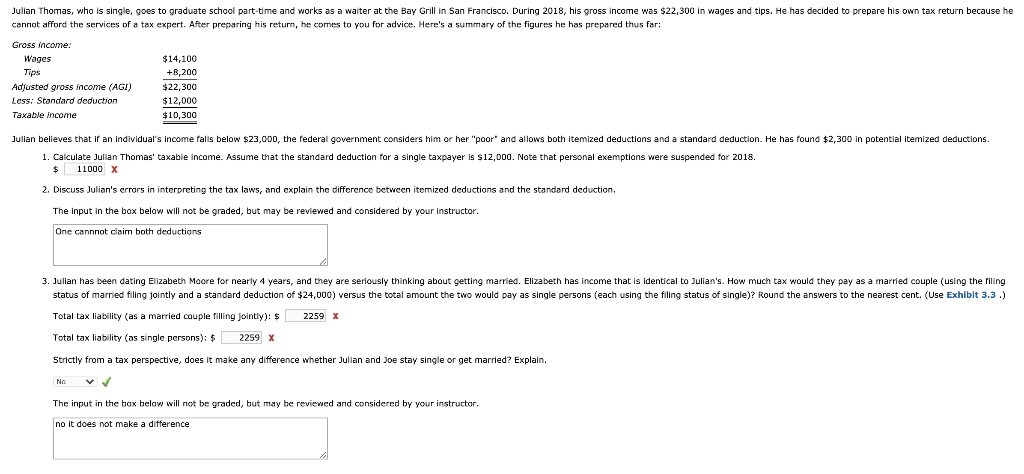

Solved Julian Thomas Who Is Single Goes To Graduate School Chegg Com

3 Startup Tax Credit Programs You Need To Know Built In

Social Security How Much Do You Pay In Taxes On Your Ss Payments Marca

401k Calculator Paycheck Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts

What Is It Like Making Around 80k 90k In San Jose California Out Of College Working As An Information Technology Analyst Engineer Quora

Step By Step Guide Using The Foreign Earned Income Exclusion To Reduce Taxes

Venture Debt Pre Payment Penalty

How Long To Keep Tax Records For Business

5 Best Crypto Tax Software To Ease Your Calculation Marca

401k Calculator Paycheck Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive Parts